Understanding the Tax Implications of NFTs – Nonfungible Tokens

Just when you thought that the world of finances couldn’t possibly become any weirder or more complex, somebody comes up with a new idea to challenge our understanding.

When FDR started the process of taking the U.S. dollar off the gold standard in 1933 and Nixon completed the process in 1971, they were unaware of where technology would lead us decades later. They had no clue that they were essentially opening the Pandora’s box of alternative currencies — first with cryptocurrencies like Bitcoin and ETH, and now with Nonfungible Tokens (NFTs).

These and other digital currencies and assets are not only challenging traditional monetary policy across the globe but are also adding another layer of complexity to tax laws and their enforcement. While Bitcoin seeks to replace traditional currencies, some can argue that NFTs — which also rise and fall in value — are seeking to replace physical assets, and therefore are subject to income tax and capital gains taxes.

In this post, we take a deeper dive into what NFTs are and the tax implications surrounding their ownership and use.

What Are NFTs (Nonfungible Tokens)?

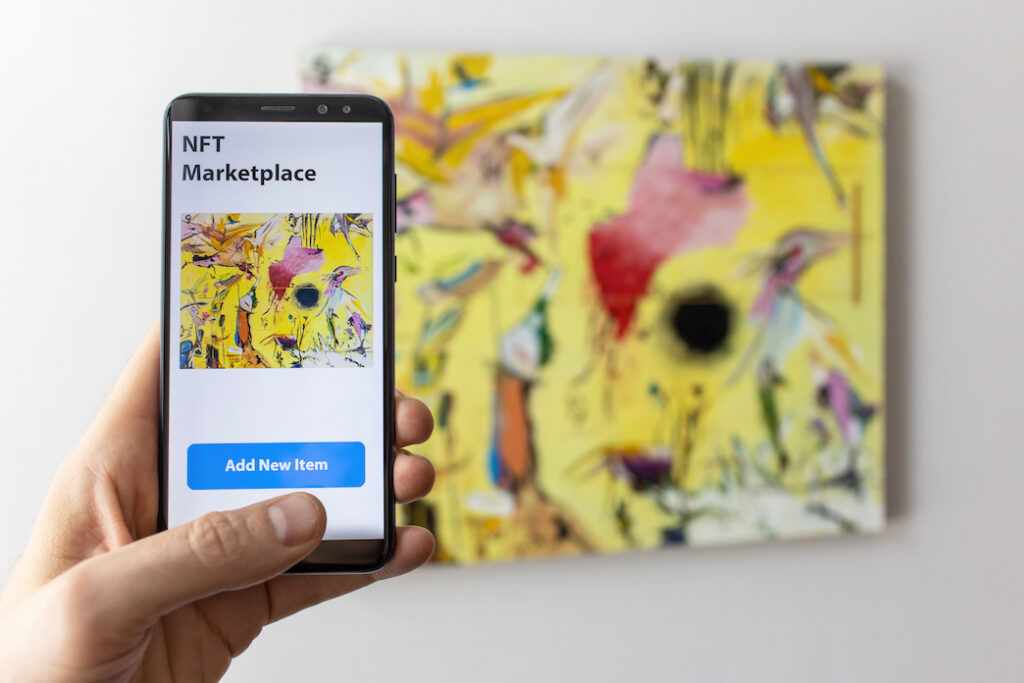

Stories about Nonfungible Tokens (NFTs) are everywhere in the news. But what exactly are they?

Nonfungible Tokens (NFTs) are digital assets that represent real-world items, from art and music to articles and sports trading cards. But these aren’t just copies of files found on the internet. NFTs are nonfungible, meaning they’re Continue reading…