Just when you thought that the world of finances couldn’t possibly become any weirder or more complex, somebody comes up with a new idea to challenge our understanding.

When FDR started the process of taking the U.S. dollar off the gold standard in 1933 and Nixon completed the process in 1971, they were unaware of where technology would lead us decades later. They had no clue that they were essentially opening the Pandora’s box of alternative currencies — first with cryptocurrencies like Bitcoin and ETH, and now with Nonfungible Tokens (NFTs).

These and other digital currencies and assets are not only challenging traditional monetary policy across the globe but are also adding another layer of complexity to tax laws and their enforcement. While Bitcoin seeks to replace traditional currencies, some can argue that NFTs — which also rise and fall in value — are seeking to replace physical assets, and therefore are subject to income tax and capital gains taxes.

In this post, we take a deeper dive into what NFTs are and the tax implications surrounding their ownership and use.

What Are NFTs (Nonfungible Tokens)?

Stories about Nonfungible Tokens (NFTs) are everywhere in the news. But what exactly are they?

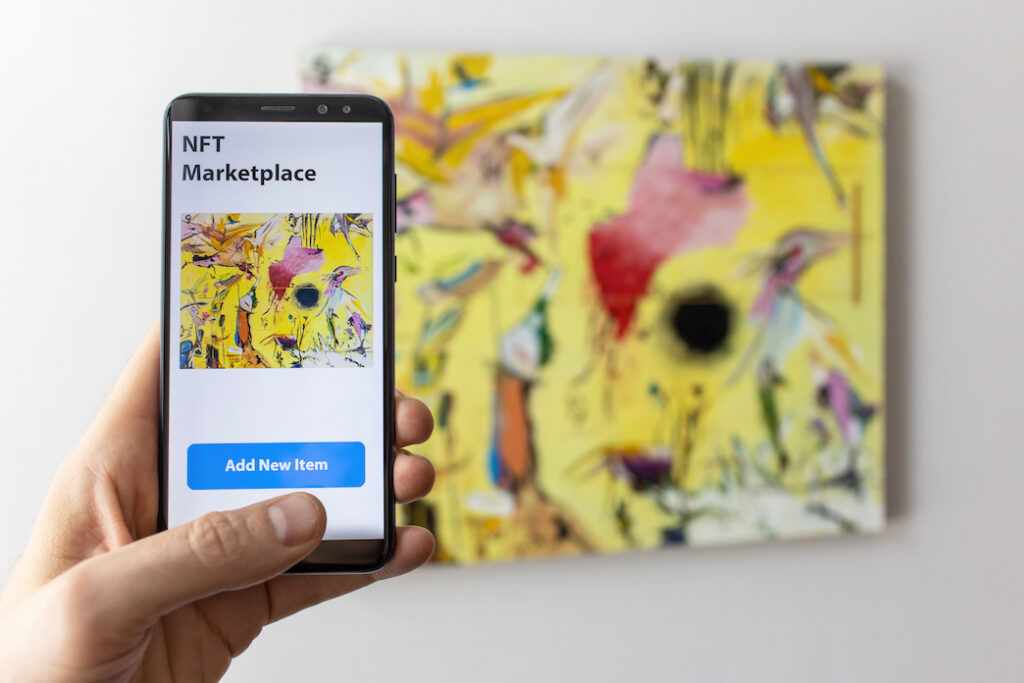

Nonfungible Tokens (NFTs) are digital assets that represent real-world items, from art and music to articles and sports trading cards. But these aren’t just copies of files found on the internet. NFTs are nonfungible, meaning they’re unique and not mutually interchangeable. Thanks to blockchain (the same technology that enables the existence of cryptocurrency — via a decentralized ledger of transactions across a peer-to-peer network), each NFT has a distinct digital signature that prevents it from being exchanged for, or treated as, equal to another NFT. In other words, you can rely on the blockchain to verify ownership of the NFT.

Photographers and artists love NFTs because they can bypass art dealers and galleries and sell directly to collectors. In addition, artists can collect royalties whenever their NFTs are purchased or exchanged, instead of earning money only on the initial sale.

NFTs have been around for years (since 2014), and they’re finally growing in popularity and expanding in their application, thanks in part to the very public moves from Tesla’s Elon Musk (he’s mocked them), Twitter’s Jack Dorsey (he sold his first tweet – as an NFT – for nearly $3 million), Snoop Dogg (he creates, buys, and sells them), and even Minnesota Republican gubernatorial candidate Dr. Scott Jensen (a donation to his campaign may yield you an NFT). Their use may possibly be expanded to product authentication, data security, supply chain management, intellectual property, ticketing, real estate, and even voting.

How to Buy and Sell NFTs

While we’re not recommending that you invest in NFTs, if you’re curious about them, here are four steps to get you started:

- Obtain a Cryptocurrency Wallet. This is a device, application, or service that stores the keys needed to authorize crypto transactions. Make sure your wallet supports Ethereum, a blockchain-based platform best known for its cryptocurrency ETH, and is used for the development of NFTs. Popular cryptocurrency wallets include MetaMask, Coinbase Wallet, Exodus (good for desktop use), and Ledger (a handheld crypto wallet).

- Purchase Ether. Ether is the cryptocurrency that functions on the Ethereum blockchain network, and it can be used to purchase NFTs and pay any related transaction fees. Around $300 in Ether is enough to get started.

- Select a Platform to Buy or Sell NFTs. Various trading platforms exist to facilitate the buying and selling of NFTs, including OpenSea, SuperRare, Nifty Gateway, and Rarible.

- Buy or Sell an NFT. Again, Ether may be used to purchase the NFT.

How NFTs Are Taxed

Before you start collecting, producing, selling, or investing in NFTs, it’s important that you understand their tax implications:

- If you create an NFT and sell it, the money you earn is subject to income tax and self-employment tax.

- To reduce the amount of that income that’s subject to taxes, be sure to deduct your business expenses associated with the creation of the NFT, just as any artist would deduct the cost of art supplies and studio expenses.

- If you purchase an NFT as an investor, you may trigger a taxable event because the cryptocurrency used to pay for the NFT is considered property for tax purposes. So, if your cryptocurrency has appreciated in value and you exchange that currency for an NFT, you will recognize taxable income.

- If you later sell the NFT at a price that exceeds its basis (what you paid for it), you will recognize a long-term or short-term capital gain depending on how long you held the asset, and that gain is taxed at the capital gains tax rate.

- The Internal Revenue Service (IRS) may also treat your NFT as a collectible, which is taxed at a maximum rate of 28 percent. Although this is a gray area in the law, we would want to fully understand the nature of your NFT to determine whether it qualifies as a collectible.

As you can see, NFTs are complicated and can give rise to multiple layers of tax. Before you decide to buy or sell an NFT, we would want to consult with you to discuss the potential financial benefits and risks, especially tax risks.

Please be aware that we are not promoting NFTs or cryptocurrency or encouraging you to invest in them. Nor are we discouraging you from doing so. Ultimately, your investment decisions are up to you, and should be based on your own financial goals and objectives. Everyone has a different risk tolerance and a different level of understanding and insight into various investment options. Our role at SWC is to assist you in evaluating the investment opportunities you are considering both in terms of their potential for generating positive returns and their risks, as well as their tax-related implications.

If you have any questions or would like to discuss NFTs or any other investment opportunities and their tax implications in greater depth, please contact us.

– – – – – – – –

Disclaimer: The information in this blog post about the tax implications of collecting, producing, selling, or investing in Nonfungible Tokens (NFTs) is provided for general informational purposes only and may not reflect current financial thinking or practices. No information contained in this post should be construed as financial advice from the staff at SWC (Stees, Walker & Company, LLP), nor is this the information contained in this post intended to be a substitute for financial counsel on any subject matter or intended to take the place of hiring a Certified Public Accountant in your jurisdiction. No reader of this post should act or refrain from acting on the basis of any information included in, or accessible through, this post without seeking the appropriate financial planning advice on the particular facts and circumstances at issue from a licensed financial professional in the recipient’s state, country or other appropriate licensing jurisdiction.

Leave A Comment